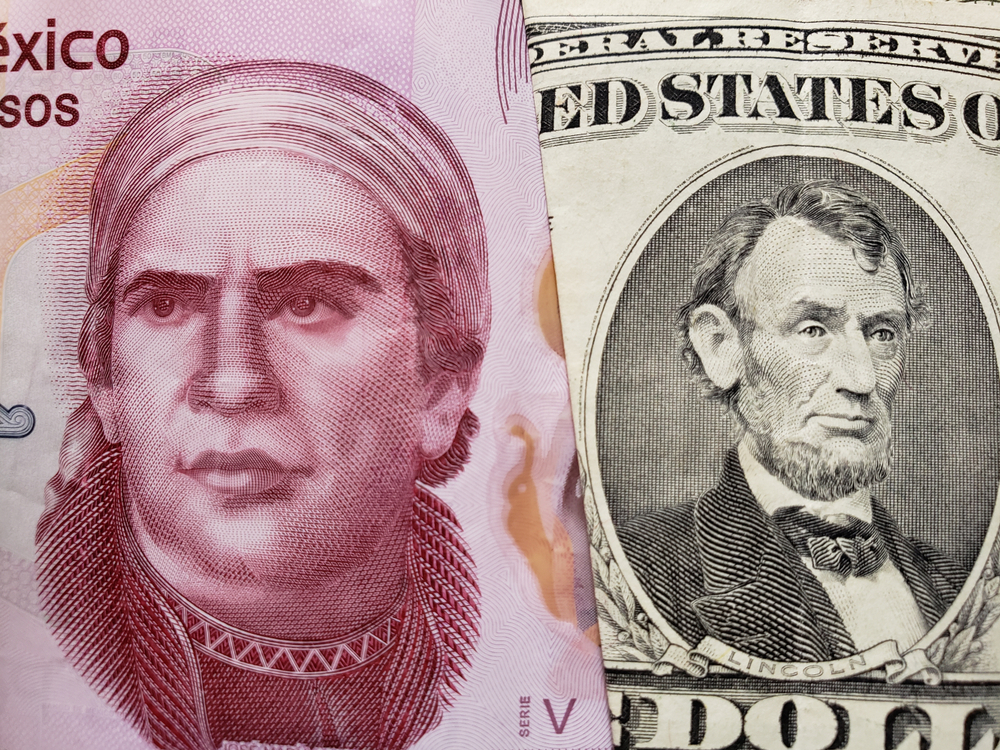

The global currencies market is one of the most dynamic and complex financial systems, constantly shifting in response to global economic events, trade relations, and investor sentiment. Among the many important currency pairs, the American dollar to Mexican peso has become one of the most closely observed. Whether you are a traveller, investor, or international business owner, keeping an eye on this exchange rate is crucial to managing costs, investments, and overall financial planning.

The American dollar to Mexican peso exchange rate serves as a vital indicator of the economic relationship between the United States and Mexico. This rate not only affects importers and exporters but also influences tourism, remittances, and investment flows between the two nations. Many global investors and currency traders regularly monitor this pair to capitalize on short-term fluctuations or hedge against future risks.

Overview of the American Dollar to Mexican Peso Exchange Rate

The American dollar to Mexican peso rate represents how many Mexican pesos one US dollar can buy. This rate is influenced by the demand and supply for both currencies in the global market. When investors have confidence in the US economy, the dollar tends to strengthen, leading to a higher value compared to the peso. Conversely, when the Mexican economy shows resilience or growth, the peso may appreciate, leading to a lower exchange rate.

Why is this currency pair important in trade and travel?

The US dollar versus the Mexican peso relationship is one of the most traded pairs in the forex trading market due to the strong economic connections between the two nations. The United States is Mexico’s largest trading partner, and a significant percentage of Mexico’s exports are priced in US dollars. This means any fluctuation in the dollar vs Mexican peso rate can have direct implications on trade balance, import costs, and profit margins for businesses operating across borders.

For travellers, this currency pair determines how much their money is worth when visiting Mexico or the United States. A strong dollar makes travel to Mexico cheaper for Americans, while a strong peso increases the cost for Mexican travellers visiting the US.

The relationship between the US dollar in the Mexico peso also plays a critical role in remittances. Millions of Mexicans living in the United States send money back home, and the exchange rate determines how much value their families receive in pesos.

Overall, the American dollar to Mexican peso exchange rate affects trade, travel, and investment decisions, making it one of the key indicators in North American economic relations.

Current USD to MXN Exchange Rate

As of today, the American dollar to Mexican peso exchange rate continues to fluctuate based on market conditions, investor sentiment, and economic indicators. This rate is constantly updated across major forex platforms and currency converters such as Evest, providing traders and consumers with real-time data.

The US dollar to the Mexican peso rate is typically quoted as USD/MXN. For example, if 1 USD equals 18.50 MXN, it means one American dollar can buy 18.50 Mexican pesos. This rate, however, changes frequently throughout the day as the foreign exchange market operates 24 hours, driven by banks, corporations, and traders worldwide.

The value of the US dollar Mexican peso pair is influenced by multiple factors such as inflation, interest rates, and international trade data. For instance, when the US Federal Reserve raises interest rates, it often leads to a stronger dollar, which means the American dollar to Mexican peso rate increases. Similarly, economic or political uncertainty in Mexico may weaken the peso.

For travellers, knowing the American dollar to Mexican peso rate is essential for budgeting and currency exchange planning. For traders and investors, it presents opportunities for profit through strategic trades. Platforms like Evest allow users to view live exchange rates, monitor trends, and even engage in forex trading efficiently and securely.

Historical Performance of the American Dollar to Mexican Peso

The history of the American dollar to Mexican peso exchange rate reveals a fascinating story of economic cycles, global events, and evolving trade relations. Over the decades, the rate has experienced both periods of stability and dramatic fluctuations, largely influenced by economic policies, oil prices, and global crises.

Exchange rate history and major fluctuations

In the 1990s, the US dollar in Mexico peso rate was highly volatile due to economic reforms and the 1994 Mexican peso crisis. The peso’s sharp devaluation during that period led to a surge in the exchange rate, dramatically changing Mexico’s economic landscape. Since then, the peso has undergone several adjustments, becoming one of the most traded emerging-market currencies.

During the 2008 global financial crisis, the dollar vs Mexican peso rate spiked as investors sought safe-haven currencies like the US dollar. The peso weakened sharply, reflecting global uncertainty. Similarly, in 2020, the COVID-19 pandemic disrupted both economies, causing another wave of volatility in the US dollar to the Mexican peso rate.

Over time, Mexico’s economy has shown remarkable resilience. The peso has often recovered from downturns due to strong exports, remittances, and investment inflows. However, political shifts, inflation, and changes in US monetary policy continue to drive short-term fluctuations in the American dollar to Mexican peso value.

Key economic and political events influencing the pair

Several key events have historically shaped the US dollar Mexican peso relationship:

- Trade agreements such as NAFTA and later USMCA have strengthened trade ties, stabilizing the currency pair.

- Oil price fluctuations significantly impact Mexico’s economy, as it remains a key oil exporter.

- Federal Reserve and Banco de México policies influence the interest rate differentials that drive forex movements.

- Political developments and election outcomes in both countries can either boost or weaken investor confidence, directly affecting the American dollar to Mexican peso exchange rate.

Understanding these historical patterns helps traders and analysts forecast potential future movements and make informed trading decisions on online trading Platforms like Evest.

Factors Affecting the USD/MXN Exchange Rate

Several factors influence the American dollar to Mexican peso exchange rate, making it essential to understand both domestic and global drivers that move this currency pair.

US and Mexico economic indicators

Economic data such as GDP growth, employment rates, and consumer confidence play a major role. When the US economy performs well, investors tend to favour the dollar, increasing its value against the peso. Conversely, when Mexico posts strong economic numbers, the peso tends to appreciate against the US dollar.

Inflation, interest rates, and central bank policies

Interest rate decisions by the Federal Reserve and Banco de México are among the most significant drivers of the US dollar versus the Mexican peso rate. Higher interest rates in the US attract foreign investment, leading to a stronger dollar, while lower rates can have the opposite effect.

Inflation also affects purchasing power and exchange rate stability. A country with high inflation tends to see its currency weaken over time.

Global oil prices and trade relations

Mexico is one of the largest oil producers in Latin America, and oil exports are vital to its economy. When oil prices rise, Mexico earns more revenue, supporting a stronger peso. Conversely, falling oil prices can weaken the peso relative to the dollar.

Trade relations between the two countries are also essential. Any disruptions in imports, exports, or tariffs can impact the American dollar to Mexican peso rate, making it crucial for investors to monitor bilateral agreements closely.

Economic Trends Shaping the Exchange Rate’s Future

The American dollar to Mexican peso exchange rate will continue to evolve with global economic trends. Factors such as the pace of US economic recovery, technological innovation, and shifts in global trade will all influence future valuations.

Emerging trends like digital currencies and fintech solutions are also reshaping how currencies are traded and valued. With platforms like Evest, traders can access real-time data, automated trading tools, and expert insights to make smarter investment decisions in the US dollar Mexican peso market.

Mexico’s ongoing economic reforms, focus on renewable energy, and manufacturing growth are likely to strengthen the peso’s fundamentals in the long term. Meanwhile, global inflation pressures, oil price volatility, and geopolitical tensions will continue to introduce short-term fluctuations.

Tips for Currency Exchange

When exchanging American dollars for Mexican pesos, timing and method can significantly affect how much value you get.

When to exchange dollars for pesos?

The best time to exchange dollars for pesos depends on market trends and travel plans. Generally, it’s wise to exchange currency when the US dollar to the Mexican peso rate is high, meaning your dollar buys more pesos. Monitoring platforms like Evest help you stay updated with live exchange rates and forecasts.

Avoid exchanging money at airports or tourist zones, where rates are less favourable. Instead, use reputable banks or online forex platforms. If you’re a trader, adopting risk management techniques and studying historical data can help you make profitable decisions when dealing with the dollar vs Mexican peso market.

Evest Services

Evest Services offers financial and investment solutions to a wide range of clients. Its activities provide a general perspective on its role and impact in the market.

Commission-Free Stock Trading

Evest allows clients to trade global stocks with zero commission, making it an attractive choice for investors who want to access international markets with minimum costs.

CFD Trading

The platform provides access to a wide range of financial assets through CFD trading (CFDs), including stocks, forex, indices, commodities, and cryptocurrencies. This gives traders great flexibility to diversify their strategies.

WebTrader Platform

Evest offers a WebTrader platform that works directly from the browser without the need to download extra software. It features a user-friendly interface with real-time charts and analysis tools to help investors make better trading decisions.

Copy Trading

With the copy trading service, beginners or passive investors can automatically copy the trades of professional traders. This allows users to benefit from the experience of experts and potentially generate steady profits.

Demo Account

Evest provides a free demo account where traders can practice with virtual funds. This service is especially useful for beginners to learn trading basics and test strategies without risking real money.

Islamic Trading Accounts

Evest offers Islamic (Swap-Free) accounts that are free from interest charges, making them compliant with Shariah law and suitable for Muslim traders.

Smart Analytics Tool (Evest Analytics)

The platform integrates AI-powered analytics tools that deliver accurate market insights and instant alerts, helping traders to identify investment opportunities at the right time.

Mobile Trading App

Evest provides a modern mobile application for iOS and Android, enabling users to trade anywhere, anytime, with the same tools and features available on the web platform.

Multiple Deposit & Withdrawal Options

Evest supports various payment methods for deposits and withdrawals, including:

- Credit and debit cards

- E-wallets

- Bank transfers

This ensures flexible and convenient financial transactions for traders worldwide.

In Conclusion

The American dollar to Mexican peso exchange rate reflects the deep economic ties between the United States and Mexico. Understanding how it works helps travellers, traders, and investors make smarter financial choices. With platforms like Evest, users can easily monitor live rates, access trading tools, and explore global currency opportunities efficiently.

Whether you’re exchanging currency for travel, investing in forex, or analyzing trade trends, staying informed about the US dollar Mexican peso market ensures you make confident decisions in an ever-changing global economy.

FAQs

Is the dollar strong in Mexico today?

The dollar’s strength depends on current market conditions and global factors. Check Evest for the latest American dollar to Mexican peso updates.

How much is $1 US in Mexico today?

The rate varies daily. On most trading platforms, you can see the real-time US dollar to Mexico peso rate.

How can I convert USD to MXN online?

Platforms like Evest offer secure online conversion and trading tools for US dollar to Mexican peso transactions.

How does inflation impact the dollar-to-peso rate?

Higher inflation in either country can weaken its currency, directly influencing the dollar vs Mexican peso exchange rate.

How can travellers save money when exchanging USD to MXN?

Platforms like Evest offer secure online conversion and trading tools for US dollar to Mexican peso transactions.