Gold has been a cornerstone of wealth and financial security for centuries, serving as both a store of value and a hedge against economic uncertainty. Today, investors, traders, and institutions closely monitor gold price forecasts to make informed decisions about buying, selling, or holding this precious metal. With markets becoming increasingly interconnected and influenced by a myriad of factors, understanding the latest trends and future projections is crucial.

The purpose of this article is to provide a comprehensive overview of gold price forecasts, covering key factors that influence gold prices, trends predicted for 2025, and strategies for both short-term traders and long-term investors. By leveraging the insights provided, individuals can make better decisions regarding gold investments, align their portfolios with market expectations, and manage risk effectively.

In addition, this guide will explore the tools used for forecasting, including gold charts, gold graphs, and market signals, as well as how global financial events and geopolitical developments impact gold price predictions. Whether you are a seasoned investor or a beginner looking to enter the precious metals market, this guide aims to equip you with the knowledge needed to navigate the complexities of gold trading and investing.

What is Gold and What Affects Its Price?

Gold is a precious metal that has long been regarded as a symbol of wealth and security. Unlike fiat currencies, it cannot be printed or artificially manipulated, making it a finite and tangible asset. Its price is determined by a combination of factors that reflect global economic conditions, investor sentiment, and supply-demand dynamics.

Primary factors influencing gold prices include:

- Global Economic Conditions and Inflation: Gold is often seen as a hedge against inflation. When currencies lose purchasing power, investors turn to gold, driving its price higher. Economic instability, recession fears, or fiscal crises tend to increase demand for gold as a safe-haven asset.

- Interest Rates and Currency Fluctuations: Rising interest rates generally increase the opportunity cost of holding gold, leading to lower demand. Conversely, when interest rates are low or negative, gold price forecasts often show an upward trajectory. Additionally, fluctuations in major currencies, particularly the U.S. dollar, directly affect gold prices, as it is primarily traded in USD.

- Geopolitical Tensions and Market Uncertainty: Conflicts, political instability, or tensions between nations often lead investors to flock to gold. Events like wars, sanctions, or international disputes create uncertainty, making gold a preferred choice for capital preservation.

- Supply and Demand Dynamics: The production of gold from mines, recycling of old jewelry, and industrial demand all affect prices. When demand outpaces supply, prices rise; conversely, an oversupply can suppress gold price expectations.

Understanding these fundamentals is crucial for interpreting gold price predictions and forming strategies to capitalize on market movements.

Factors Influencing Gold Prices

The movement of gold prices is influenced by a complex interplay of economic, financial, and geopolitical factors. Here’s a deeper look:

- Global Economic Conditions and Inflation: Persistent inflation reduces the real value of cash, making gold a preferred store of value. Historical data suggests that during periods of high inflation, gold price forecasts tend to indicate bullish trends.

- Interest Rates and Currency Fluctuations: Low-interest rates reduce the yield on bonds and savings accounts, pushing investors toward gold. Fluctuations in the U.S. dollar also have a significant impact. A weaker USD generally results in higher gold prices, while a stronger USD can depress them.

- Geopolitical Tensions and Market Uncertainty: Global events like trade wars, military conflicts, and political instability increase the appeal of gold as a hedge. Investors often respond by buying gold, affecting both spot prices and futures contracts.

- Supply and Demand Dynamics: Gold mining output, the sale of gold reserves by central banks, and consumer demand for jewelry and technology all play critical roles. Seasonal demand, particularly in countries like India and China, can also impact gold market forecasts.

By monitoring these factors, traders can align their decisions with broader market trends and refine their gold price predictions for both short-term trading and long-term investment.

Gold Market Forecast 2025

Looking ahead to 2025, analysts and financial institutions provide gold market forecasts based on a combination of historical trends, current economic indicators, and geopolitical events.

- Predicted Trends: Experts expect gold to continue its role as a safe-haven asset, with price fluctuations linked closely to inflation, interest rate movements, and geopolitical stability. Short-term volatility may arise from unexpected economic announcements, while long-term trends suggest steady appreciation in response to global uncertainty.

- Short-Term vs Long-Term Forecasts: Short-term gold price predictions are often influenced by daily market sentiment, currency movements, and trading volume. Long-term forecasts, however, focus on macroeconomic conditions, monetary policy trends, and structural changes in supply and demand.

- Key Signals to Watch: Traders should observe central bank announcements, inflation reports, bond yields, and major geopolitical developments. Technical analysis online trading tools like gold charts and USD correlation graphs also provide critical insight into potential price movements.

Overall, the 2025 outlook for gold remains cautiously optimistic, with potential for both strategic investment gains and hedging benefits.

Gold Price Forecasts Expectations

Setting realistic gold price expectations requires a blend of historical analysis, current market trends, and forward-looking indicators.

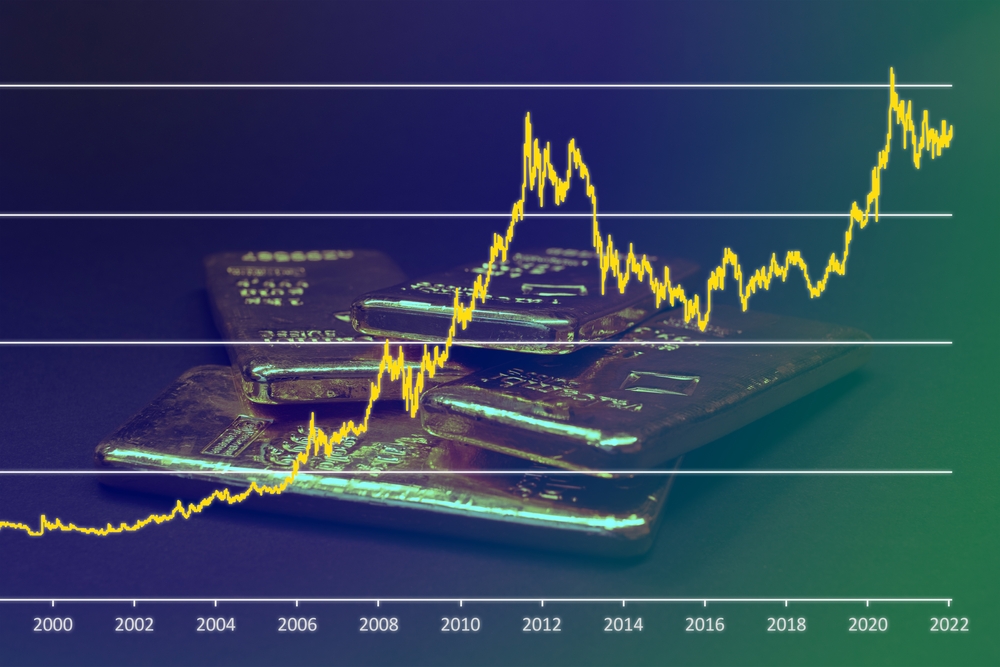

- Using Historical Data: Past price movements provide context for future predictions. Patterns, cyclical trends, and historical highs and lows inform gold price forecasts.

- Analytical Tools: Investors rely on gold charts, gold graphs, and market signals to interpret price action. Technical indicators like moving averages, RSI, and MACD help gauge market sentiment.

- Impact of Financial News: Global economic updates, central bank reports, and trade announcements influence expectations. Markets react swiftly to news, affecting both spot and futures prices.

By incorporating these tools, investors can develop informed gold price predictions that guide their trading and long-term investment strategies.

Gold Investment Forecast

A well-researched gold investment forecast considers opportunities for both traders and long-term investors:

- Opportunities: Gold offers portfolio diversification, risk mitigation, and potential capital appreciation. It can be invested in physical form, ETFs, futures contracts, or gold mining stocks.

- Risks: Despite its safe-haven status, gold is subject to market volatility, geopolitical events, and currency fluctuations. Investors should be prepared for potential short-term losses.

- Comparisons: When evaluating gold, investors often compare it with other commodities, equities, or bonds. Gold typically performs well during economic uncertainty, making it a defensive asset in turbulent markets.

A thoughtful approach to gold investment forecasts allows investors to balance risk and reward effectively.

How to Use Gold Price Predictions

Using gold rate forecasts effectively requires a combination of strategy, timing, and risk management:

- Buying and Selling Decisions: Investors can plan entry and exit points using technical analysis and market indicators. Gold price predictions inform whether to buy during dips or sell during rallies.

- Trading Strategies: Incorporating forecasts into trading strategies can enhance decision-making. Trend-following, swing trading, and hedging strategies benefit from accurate projections.

- Investment Planning: Long-term investors use gold price expectations to structure their portfolios, ensuring allocation aligns with risk tolerance and market outlook.

By leveraging forecasts, traders and investors can make informed decisions, maximize returns, and minimize exposure to adverse market movements.

Evest Services

Evest offers a comprehensive range of services designed to support traders at every level. From powerful trading tools to educational resources, the platform provides everything you need for a seamless and informed trading experience.

Commission-Free Stock Trading

Evest allows clients to trade global stocks with zero commission, making it an attractive choice for investors who want to access international markets with minimum costs.

CFD Trading

The platform provides access to a wide range of financial assets through Contracts for Difference (CFDs), including stocks, forex, indices, commodities, and cryptocurrencies. This gives traders great flexibility to diversify their strategies.

WebTrader Platform

Evest offers a WebTrader platform that works directly from the browser without the need to download extra software. It features a user-friendly interface with real-time charts and analysis tools to help investors make better trading decisions.

Copy Trading

With the copy trading service, beginners or passive investors can automatically copy the trades of professional traders. This allows users to benefit from the experience of experts and potentially generate steady profits.

Demo Account

Evest provides a free demo account where traders can practice with virtual funds. This service is especially useful for beginners to learn trading basics and test strategies without risking real money.

Islamic Trading Accounts

Evest offers Islamic (Swap-Free) accounts that are free from interest charges, making them compliant with Shariah law and suitable for Muslim traders.

Smart Analytics Tool (Evest Analytics)

The platform integrates AI-powered analytics tools that deliver accurate market insights and instant alerts, helping traders to identify investment opportunities at the right time.

Mobile Trading App

Evest provides a modern mobile application for iOS and Android, enabling users to trade anywhere, anytime, with the same tools and features available on the web platform.

Through the mobile webtrader, which provides a communication interface and support tools within the app itself.

Multiple Deposit & Withdrawal Options

Evest supports various payment methods for deposits and withdrawals, including:

- Credit and debit cards

- E-wallets

- Bank transfers

This ensures flexible and convenient financial transactions for traders worldwide.

Conclusion

Gold price forecasts play a critical role in shaping investment strategies for traders and long-term investors alike. By understanding the factors that influence gold prices, monitoring market signals, and using historical data for reference, investors can make informed decisions and better manage risk.

Gold remains a reliable hedge against economic uncertainty, inflation, and geopolitical instability. Whether utilizing ETFs, physical gold, or futures contracts, informed investment based on gold price predictions can provide both financial security and growth opportunities.

For anyone looking to enter the gold market or refine their trading strategy, closely following market trends and forecasts is essential to achieving successful outcomes.

FAQs

What are gold price forecasts and why are they important?

Gold price forecasts are predictions of future gold price movements based on historical data, economic indicators, and market trends. They help investors make informed buying and selling decisions and manage risk.

How do experts predict future gold prices?

Experts use a combination of technical analysis, macroeconomic indicators, historical trends, and geopolitical developments to generate gold price predictions.

What factors most influence gold price predictions?

Inflation, interest rates, currency strength, geopolitical tensions, and supply-demand dynamics are the primary factors influencing gold market forecasts.

How accurate are gold market forecasts?

While forecasts provide valuable insights, they are not guarantees. Gold prices can be affected by sudden economic events or geopolitical crises, so forecasts should be used alongside risk management strategies.